UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| þ | Filed by the Registrant | o | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

TEXTRON INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| þ | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: | |

| (2) Aggregate number of securities to which transaction applies: | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: | |

| (4) Proposed maximum aggregate value of transaction: | |

| (5) Total fee paid: | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: | |

| (2) Form, Schedule or Registration Statement No.: | |

| (3) Filing Party: | |

| (4) Date Filed: | |

2022 PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF SHAREHOLDERS Wednesday, April 27, 2022, at 11 a.m. virtually at www.virtualshareholdermeeting.com/TXT2022

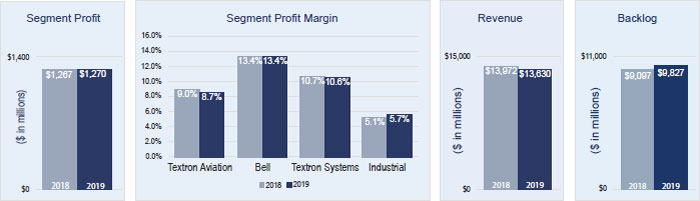

Textron’s Global Network of Businesses

| TEXTRON AVIATION Textron Aviation is home to the Beechcraft®, Cessna®and Hawker® aircraft brands and |

| BELL Bell is a leading supplier of helicopters and related spare parts and services. Bell is the pioneer of the revolutionary tiltrotor aircraft. Globally recognized for world-class customer service, innovation and superior quality, Bell’s global workforce serves customers flying Bell aircraft in more than 130 countries. |

| INDUSTRIAL Our Industrial segment offers two main product lines: fuel systems and functional components produced by Kautex; and specialized vehicles such as golf cars, recreational and utility vehicles, aviation ground support equipment and professional mowers, manufactured by Textron Specialized Vehicles businesses. |

| TEXTRON SYSTEMS Textron |

| FINANCE Our Finance segment, operated by Textron Financial Corporation (TFC), is a commercial finance business that provides financing solutions for purchasers of Textron products, primarily Textron Aviation aircraft and Bell helicopters. For more than five decades, TFC has played a key role for Textron customers around the globe. |

NOTICE OF ANNUAL MEETING

To the Shareholders of Textron Inc.:

The 2020 annual meeting2022 Annual Meeting of shareholdersShareholders of Textron Inc. will be held on Wednesday, April 29, 202027, 2022 at 11:0011 a.m., Eastern time. To support the health and well-being of our employees and shareholders, this year’s meeting will be held virtually via a live audio webcast at www.virtualshareholdermeeting.com/TXT2022. Shareholders will not be able to attend the Company’s principal executive office located at 40 Westminster Street, Providence, Rhode Island formeeting in person. At the following purposes:meeting, our shareholders will be asked to do the following:

| To elect the ten director nominees named in the proxy statement to hold office until the next annual shareholders’ meeting; |  | Wednesday, April |

| To approve Textron’s executive compensation on an advisory basis; |   | 11:00 a.m. Eastern Daylight Time |

| To ratify the appointment by the Audit Committee of Ernst & Young LLP as Textron’s independent registered public accounting firm for |   | |

| If properly presented at the meeting, to consider and act upon a shareholder proposal, set forth beginning on page 56 in the accompanying proxy statement, which is opposed by the Board of Directors; and | ||

| |||

You areTo be admitted to the Annual Meeting virtually, you will need to log-in to www.virtualshareholdermeeting.com/TXT2022 using the 16-digit control number found on the proxy card, voting instruction form, Notice of Internet Availability of Proxy Materials, email or legal proxy, as applicable, sent or made available to shareholders entitled to vote all shares of common stock registered in your name at the close of business on March 2, 2020. If your shares are held in the name of your broker or bank and you wish to attend the meeting in person and vote your shares, your broker or bank must issue to you a proxy covering your shares.Annual Meeting.

As permitted by the rules of the Securities and Exchange Commission, we are making our proxy materials available to shareholders primarily via the Internet, rather than mailing printed copies of these materials to shareholders. On March 6, 2020,4, 2022, we mailed to many of our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access and review our proxy materials, including our Proxy Statement and the Annual Report to Shareholders, and vote online. This process is designed to expedite shareholders’ receipt of proxy materials, lower the cost of the annual meeting,Annual Meeting, and help conserve natural resources. If you received a Notice by mail, you will not receive a printed copy of the proxy materials unless you request one. If you would prefer to receive printed proxy materials, please follow the instructions included in the Notice. Shareholders who requested paper copies of the proxy materials or previously elected to receive our proxy materials electronically did not receive the Notice and will receive the proxy materials in the format requested.

Whether or not you plan to attend the virtual meeting, we urge you to cast your vote as soon as possible so that your shares may be represented at the meeting. You may vote your shares via the Internet or by telephone by following the instructions included on the Notice. Alternatively, if you received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card.

You are entitled to vote all shares of common stock registered in your name at the close of business on February 28, 2022. A list of shareholders entitled to vote at the 2020 annual meeting2022 Annual Meeting will be open to examination by any shareholderavailable for any purpose germane toviewing during the meeting, for ten days prior to the meeting, at Textron’s principal executive office, 40 Westminster Street, Providence, Rhode Island 02903.Annual Meeting.

By order of the Board of Directors,

E. Robert Lupone

Executive Vice President, General Counsel and Secretary

Providence, Rhode Island

March 6, 20204, 2022

| YOUR VOTE IS IMPORTANT |

| Brokers are not permitted to vote on the election of directors or on certain other proposals without instructions from the beneficial owner. Therefore, if your shares are held in the name of your broker or bank, it is important that you vote. We encourage you to vote promptly, even if you intend to attend the |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL |

| REVIEW THE PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | ||||

| BY TELEPHONE Call the telephone number on your proxy card or voting instruction form. |  | BY MAIL If you received your materials by mail, you can vote by mail by marking, dating and signing your proxy card or voting instruction form and returning it in the postage-paid envelope. | |

| BY INTERNET You can vote your shares online atwww.proxyvote.com |   | Attend the virtual meeting | |

IVTEXTRON 20202022 PROXY STATEMENT

TABLE OF CONTENTS

TEXTRON 20202022 PROXY STATEMENTV

VITEXTRON 20202022 PROXY STATEMENT

| INFORMATION ABOUT THE ANNUAL MEETING |

This proxy statement, which is first being made available to shareholders on or about March 6, 2020,4, 2022, is furnished in connection with the solicitation by the Board of Directors of Textron Inc. of proxies to be voted at the annual meeting of shareholders to be held on April 29, 2020,27, 2022, at 11:00 a.m. at the Company’s principal executive office, located at 40 Westminster Street, Providence, Rhode Island,virtually via a live audio webcast and at any adjournments or postponements thereof. Shareholders will be able to attend the Annual Meeting, vote their shares and submit questions during the meeting at www.virtualshareholdermeeting.com/TXT2022.

All shareholders of record at the close of business on March 2, 2020February 28, 2022 will be entitled to vote. As of March 2, 2020,February 28, 2022, Textron had outstanding 227,645,495216,329,378 shares of common stock, each of which is entitled to one vote with respect to each matter to be voted upon at the meeting. Proxies are solicited to give all shareholders who are entitled to vote on the matters that come before the meeting the opportunity to do so whether or not they attend the meeting in person.meeting.

INTERNET AVAILABILITY OF PROXY MATERIALS

As permitted by the rules of the Securities and Exchange Commission, we are making our proxy materials available to shareholders primarily via the Internet, rather than mailing printed copies of these materials to shareholders. On March 6, 2020,4, 2022, we mailed to many of our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access and review our proxy materials, including our Proxy Statement and the Annual Report to Shareholders, and vote online.

This process is designed to expedite shareholders’ receipt of proxy materials, lower the cost of the annual meeting,Annual Meeting, and help conserve natural resources. If you received a Notice by mail, you will not receive a printed copy of the proxy materials unless you request one. If you would prefer to receive printed proxy materials, please follow the instructions included in the Notice. Shareholders who requested paper copies of the proxy materials or previously elected to receive our proxy materials electronically did not receive the Notice and will receive the proxy materials in the format requested.

Shareholders of record may vote via the Internet or by using the toll-free telephone number listed on the proxy card. Please follow the instructions for Internet or telephone voting provided on the proxy card or Notice. Alternatively, if you received paper copies of the proxy materials by mail, you can vote by mail by following the instructions on the proxy card. If you vote via the Internet or by telephone, please do not return a signed proxy card. Shareholders who hold their shares through a bank or broker can vote via the Internet or by telephone if these options are offered by the bank or broker. If you received the proxy materials in paper form from your bank or broker, the materials include a voting instruction form so you can instruct the holder of record on how to vote your shares.

If voting by mail, please complete, sign, date and return your proxy card enclosed with the proxy statement in the accompanying postage-paid envelope. You can specify how you want your shares voted on each proposal by marking the appropriate boxes on the proxy card. If your proxy card is signed and returned without specifying a vote or an abstention on any proposal, it will be voted according to the recommendation of the Board of Directors on that proposal. That recommendation is shown for each proposal on the proxy card.

You also may vote in person at the meeting.If your shares are held induring the nameAnnual Meeting (up until the closing of your broker or bank andthe polls) by following the instructions available at www.virtualshareholdermeeting.com/TXT2022 if you wish to vote in person atattend the meeting, you must request your broker or bank to issue you a proxy covering your shares.meeting.

If you are a participant in a Textron savings plan with athe Textron stock fund as an investment option, when you vote via the Internet or by telephone, or your proxy card is returned properly signed, the plan trustee will vote your proportionate interest in the plan shares in the manner you direct, or if you vote by mail and make no direction, in proportion to directions received from the other plan participants (except for any shares allocated to your Tax Credit Account under the Textron Savings Plan which will be voted only as you direct). All directions will be held in confidence.

TEXTRON 20202022 PROXY STATEMENT 1

Whether voting by mail, via the Internet or by telephone, if you are a shareholder of record, you may change or revoke your proxy at any time before it is voted by submitting a new proxy with a later date, voting via the Internet or by telephone at a later time, delivering a written notice of revocation to Textron’s Secretary, or voting in person atduring the meeting. If your shares are held in the name of your broker or bank, you may change or revoke your voting instructions by contacting the bank or brokerage firm or other nominee holding the shares or by obtaining a legal proxy from such institution and voting in person atduring the annual meeting.Annual Meeting.

A quorum is required to conduct business at the meeting. A quorum requires the presence, in person orincluding by proxy, of the holders of a majority of the issued and outstanding shares entitled to vote at the meeting. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker non-vote occurs when you fail to provide voting instructions to your broker for shares owned by you but held in the name of your broker and your broker does not have authority to vote without instructions from you.broker. Under those circumstances, your broker may be authorizedis allowed, but not required, to vote for you without your instructions on routine matters but is prohibited from voting without your instructions on non-routine matters. The ratification of independent registered public accountants is a routine matter on which your broker may vote your shares without your instructions. Non-routine matters include the election of directors, and the advisory vote to approve Textron’s executive compensation.compensation and the shareholder proposal. Those items for which your broker cannot vote result in broker non-votes. In order to ensure that your shares are voted on all proposals, we encourage you to return your voting instruction form or vote electronically or by telephone as soon as possible, even if you intend to attend the Annual Meeting.

Election of each of the nominees for director requires a vote of the majority of the votes cast at the meeting, which means that the number of shares voted “for” a nominee for director must exceed the number of shares voted “against” that nominee. Abstentions and broker non-votes are not counted for this purpose and will have no effect on the outcome of the election.

Approval of all other matters to be voted on at the meeting requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on the matter. Abstentions will have the same effect as votes “against” the proposal, and broker non-votes (when applicable) will have no effect on the outcome of the vote.

Textron pays the cost of this solicitation of proxies. Textron will request that persons who hold shares for others, such as banks and brokers, solicit the owners of those shares and will reimburse them for their reasonable out-of-pocket expenses for those solicitations. In addition to solicitation by mail, Textron employees may solicit proxies by telephone, by electronic means and in person, without additional compensation for these services. Textron has hired Alliance Advisors, LLC of Bloomfield, New Jersey, a proxy solicitation organization, to assist in this solicitation process for a fee of $16,000,$16,500, plus reasonable out-of-pocket expenses.

Under Textron’s policy on confidential voting, individual votes of shareholders are kept confidential from Textron’s directors, officers and employees, except for certain specific and limited exceptions. Comments of shareholders written on proxies or ballots are transcribed and provided to Textron’s Secretary. Votes are counted by Broadridge Financial Solutions, Inc. and certified by an independent Inspector of Election.

If

The live audio webcast of the Annual Meeting will begin promptly at 11:00 a.m. Eastern Time. Online access to the audio webcast will open 15 minutes prior to the start of the Annual Meeting to allow time for you to log-in and test your shares are held in the name of your bank or broker anddevice’s audio system. We encourage you plan to attendaccess the meeting please bring proofin advance of ownership with you to the meeting. A bank or brokerage account statement showing that you owned voting stock of Textron on March 2, 2020 is acceptable proof to obtain admittance to the meeting. If you are a shareholder of record, no proof of ownership is required. All shareholders or their proxies should be prepared to present government-issued photo identification upon request for admission to the meeting.designated start time.

2 TEXTRON 20202022 PROXY STATEMENT

To be admitted to the Annual Meeting virtually, you will need to log-in to www.virtualshareholdermeeting.com/TXT2022 using the 16-digit control number found on the proxy card, voting instruction form, Notice of Internet Availability of Proxy Materials or email, as applicable, sent or made available to shareholders entitled to vote at the Annual Meeting. Shareholders whose shares are held in street name and whose voting instruction form or Notice of Internet Availability does not contain a control number for attending the Annual Meeting, should contact their bank, broker or other nominee (preferably at least 5 days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in or vote at the Annual Meeting.

Beginning 15 minutes prior to, and during, the Annual Meeting, we will have support available to assist shareholders with any technical difficulties they may have accessing or hearing the virtual meeting. If you encounter any difficulty accessing, or during, the virtual meeting, please call the support team at the toll-free number on the virtual Annual Meeting log-in page which will be available beginning 15 minutes prior to the meeting.

You can view the Agenda and the Rules of Conduct for the Annual Meeting after you log-in to the virtual meeting website at www.virtualshareholdermeeting.com/TXT2022. Shareholders may submit questions related to the Company’s business or governance or related to the items of business set forth on the Agenda beginning fifteen (15) minutes prior to, and during, the Annual Meeting at www.virtualshareholdermeeting.com/TXT2022. The Rules of Conduct will also be available beginning five days prior to the Annual Meeting (on or prior to April 22, 2022) at www.proxyvote.com.

A webcast playback of the Annual Meeting will be available at www.virtualshareholdermeeting.com/TXT2022 within approximately 24 hours after the completion of the meeting. If any shareholder questions that comply with the Rules of Conduct are submitted but not answered during the meeting, we will post responses to those questions with the Annual Meeting materials on Textron’s website, www.textron.com, under “Investors.”

TEXTRON 2022 PROXY STATEMENT 3

| ELECTION OF DIRECTORS |

BOARD MEMBERSHIP QUALIFICATIONS

The Board of Directors believes that the Board, as a whole, should possess a combination of skills, professional experience and diversity of backgrounds necessary to oversee the Company’s business. Accordingly, the Board and the Nominating and Corporate Governance Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and the Company’s current and future needs. In addition, the Board believes that there are certain attributes that every director should possess, as reflected in the Board’s membership criteria which are developed and recommended to the Board by the Nominating and Corporate Governance Committee. All of our current Board members share certain qualifications and attributes consistent with these criteria, which are set forth in the Company’s Corporate Governance Guidelines and Policies and are summarized below:

Board Membership Criteria

| Exemplary personal ethics and integrity | Core business competencies of | Financial literacy and a history of making good business decisions and exposure to best practices | ||

| Enthusiasm for Textron and sufficient time to be fully engaged | Strong communications skills and confidence to ask tough questions | Interpersonal skills that maximize group dynamics, including respect for others | ||

| Specific skills and experience aligned with Textron’s strategic direction and operating challenges and that complement the overall composition of the Board | ||||

At the 20202022 annual meeting, ten directors are to be elected to hold office until the 20212023 annual meeting and until their successors have been elected and qualified. AllNine of our ten nominees are currently Textron directors. Lionel L. Nowell III, who was recommended by a third-party search firm, wasdirectors, and Richard F. Ambrose has been appointed as a director by the Board, effective JanuaryApril 1, 2020.2022, in anticipation of the vacancy which will result when Paul E. Gagné, a director since 1995, retires from our Board effective as of the Annual Meeting in accordance with our retirement policy. Mr. Ambrose was recommended by a third-party search firm and then evaluated and interviewed by members of the Nominating and Corporate Governance Committee, as well as most other members of the Board, prior to his appointment. The search firm assisted the Company in identifying and evaluating director candidates for a fee paid by the Company. It is the intention of the persons named as proxies for the annual meeting,Annual Meeting, unless otherwise instructed, to vote “for” each of the directors who have been nominated for election. If any director nominee is unable or unwilling to serve as a nominee at the time of the annual meeting,Annual Meeting, the persons named as proxies will vote for the balance of the nominees and may vote for a substitute nominee designated by the present Board. Both Lawrence K. Fish, a director since 1999, and Lloyd G. Trotter, a director since 2008, will be retiring from our Board effective as of the annual meeting in accordance with our retirement policy. At that time, the Board intends to reduce the number of directors of the Company to ten.

Our Nominating and Corporate Governance Committee and our Board have determined that each of our directorsnominees has the experience, attributes and skills needed to collectively comprise an effective and well-functioning Board. Textron’s directors have experience with businesses that operate in industries in which Textron operates or that involve skills that are integral to Textron’s operations.

4TEXTRON 20202022 PROXY STATEMENT3

Our director nominees offer an effective mix of relevant experience and skills, as illustrated below (by percentage of board members):

Director Experience and Skills

| AEROSPACE AND DEFENSE | 50% | ||||||

| FINANCE / ACCOUNTING | 40% | ||||||

| INTERNATIONAL BUSINESS | 40% | ||||||

| MARKETING AND SALES | 40% | ||||||

| OPERATIONS AND MANUFACTURING | 40% | ||||||

| PUBLIC COMPANY BOARD EXPERIENCE | |||||||

| SENIOR LEADERSHIP | 100% | ||||||

| STRATEGIC PLANNING | 60% | ||||||

| TECHNOLOGY / R&D | 40% |

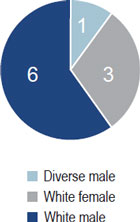

Although the Nominating and Corporate Governance Committee does not have a formal policy for considering diversity in identifying nominees for director, it seeks a variety of occupational and personal backgrounds on the Board in order to obtain a range of viewpoints and perspectives. During its recent refreshment process, increasingIncreasing the diversity of the Board, wasincluding with respect to gender and racial/ethnic diversity, is a significant focus in developing the pool from which we identifiedidentify qualified director candidates. candidates, and the Committee has advised its third-party search firm that it prioritizes enhancing the Board’s diversity.

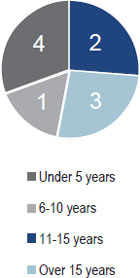

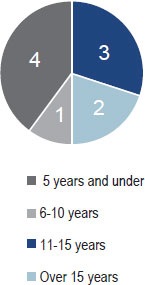

Our Board provides diverse and independent oversight, with director tenure that balances institutional knowledge with fresh perspectives, as illustrated below:

Independent Directors | Balanced Tenure | |

|   |   |

4TEXTRON 20202022 PROXY STATEMENT5

Biographical information about each nominee, as well as highlights of the specific experience,

qualifications, attributes and skills of our individual Board members, are included below:

Chairman

| Experience, Qualifications, Attributes and Skills • Significant experience in the aerospace and defense sector • Deep operational experience in innovation, manufacturing, sales and marketing, portfolio management, talent development and business processes • First-hand, real-time experience in, and understanding of, Textron operations

| ||

| Mr. Donnelly, |

| Experience, Qualifications, Attributes and Skills • Extensive operating and leadership experience in aerospace and defense industry • Deep understanding of working with the Department of Defense • Demonstrated expertise in management of U.S. government defense programs • Significant experience in research and development of advanced technology | ||

| Mr. Ambrose, 63, recently retired as the Executive Vice President – Space of Lockheed Martin Corporation, a global security and aerospace company, where he led Lockheed Martin’s $12 billion Space business which employs approximately 20,000 people and provides advanced technology systems for national security, civil and commercial customers. Prior to this role, which he assumed in 2013, he served as President, Lockheed Martin Information Systems & Global Solutions-National from 2011 through 2012 and as Vice President & General Manager, Lockheed Martin Surveillance & Navigation Systems line of business within Space from 2006 through 2010. He joined Lockheed in 2000 as Vice President & General Manager, Lockheed Martin Ground Systems and served as President, Lockheed Martin Maritime Systems & Sensors Tactical Systems from 2004 to 2006. Prior to joining Lockheed Martin, Mr. Ambrose served as President and General Manger of the Space Systems Division at Hughes Information Systems (which merged with Raytheon C3I Systems in 1997). | |||

Kathleen M. Bader

| Experience, Qualifications, Attributes and Skills • Comprehensive experience in strategic planning and change management • Expertise in managing strategic business process implementation within global industrial business environments • Extensive experience in advancing customer loyalty and employee satisfaction • Expertise in expansion of international business | ||

| Ms. Bader, |

6 TEXTRON 2022 PROXY STATEMENT

R. Kerry Clark

| Experience, Qualifications, Attributes and Skills • Extensive expertise in establishing brand equity worldwide and extending strategic initiatives globally • Leadership skills in enhancing customer service and advancing customer relationships • Significant experience in corporate governance, talent development, change management, marketing and business development • Audit Committee Financial Expert | ||

| Mr. Clark, |

TEXTRON 2020 PROXY STATEMENT 5

James T. Conway Director Since 2011 | Experience, Qualifications, Attributes and Skills • Experience managing complex operational and strategic issues • Deep understanding of the U.S. military • Broad knowledge of the defense industry and international security issues • Demonstrated leadership and management skills | ||

| Mr. Conway, |

|

| ||

Ralph D. Heath Director Since 2017 | Experience, Qualifications, Attributes and Skills • Extensive expertise in developing and growing business within the aerospace and defense industry • Deep understanding of working with the Department of Defense, including government defense program management • Significant experience in international business development in aerospace and defense markets • Audit Committee Financial Expert | ||

| Mr. Heath, | |||

6TEXTRON 20202022 PROXY STATEMENT7

| Experience, Qualifications, Attributes and Skills • Deep expertise in national security • Significant experience in U.S. government procurement and logistics • Demonstrated leadership and management skills • Extensive experience in the cybersecurity field | ||

| Ms. James, |

Lionel L. Nowell III Director Since 2020 | Experience, Qualifications, Attributes and Skills • Deep expertise in treasury functions, including debt, investments, capital markets strategies, foreign exchange and insurance • Significant experience in financial reporting and accounting of large international businesses • Extensive global perspective in risk management and strategic planning • Audit Committee Financial Expert | ||

| Mr. Nowell, |

James L. Ziemer

| Experience, Qualifications, Attributes and Skills • Extensive expertise in establishing brand equity worldwide • Leadership experience in fostering outstanding customer satisfaction and loyalty • Significant experience with the captive finance business model | ||

| Mr. Ziemer, |

8TEXTRON 20202022 PROXY STATEMENT7

Maria T. Zuber

| Experience, Qualifications, Attributes and Skills • Extensive expertise in scientific research • Considerable leadership experience, including in relationships with the federal government • Deep understanding of emerging technologies | ||

| Ms. Zuber, |

| The Board of Directors recommends a vote “FOR” each of the director nominees (Items 1a through 1j on the proxy card). |

8TEXTRON 20202022 PROXY STATEMENT9

| CORPORATE GOVERNANCE |

Textron is committed to sound corporate governance practices, including the following:

| Director Independence | ●9 of our 10 director nominees are independent, with our CEO being the only management director. ●Our three principal Board committees, the Audit, Nominating and Corporate Governance, and Organization and Compensation Committees, are each comprised of entirely independent directors. ●The independent directors meet regularly in executive session without management present. | |

| Independent Lead Director | ●Our independent directors elect a director from among them to serve as Lead Director, generally for a three-year term, with annual ratification. ●The Lead Director is assigned clearly defined and expansive duties. ●The Lead Director presides at executive sessions of the independent directors without management present at each regularly scheduled Board meeting. | |

| Board Accountability and Practices | ●All directors must stand for election annually and be elected by a majority of votes cast in uncontested elections. ●During ●The Board and each of its three principal committees perform annual ●Directors may not stand for reelection after their 75th birthday. | |

| Shareholder Rights | ●Shareholders holding 25% of our outstanding shares may call a special meeting of shareholders. ●Our By-Laws provide a majority vote standard for the election of directors in uncontested elections, and we maintain a resignation policy under which any director who fails to receive a majority vote is required to tender their resignation for consideration by the Nominating and Corporate Governance Committee and the Board. ●Our By-Laws provide for proxy access to allow eligible shareholders to include their own director nominees in the Company’s proxy materials. ●Our Board and management regularly engage with large shareholders on our executive compensation program and on ESG matters. | |

| Textron Stock | ●We have robust stock ownership requirements for both our directors and our senior executives, all of whom currently meet their respective requirements. ●Our executives and our directors are prohibited from hedging or pledging Textron securities. |

10TEXTRON 20202022 PROXY STATEMENT9

The Board of Directors has determined that Mses. Bader, James and Zuber and Messrs. Ambrose, Clark, Conway, Fish, Gagné, Heath, Nowell Trotter and Ziemer, are independent, as defined under the listing standards of the New York Stock Exchange, based on the criteria set forth in the Textron Corporate Governance Guidelines and Policies which are posted on Textron’s website as described below. In making its determination, the Board examined relationships between directors or their affiliates with Textron and its affiliates and determined that each such relationship did not impair the director’s independence. Specifically, the Board considered the fact that, in 2019,2021, the Textron Charitable Trust made a $20,000$15,000 donation to The Marine Corps UniversityWarriors & Quiet Waters Foundation, an organization for which Mr. Conway serves as Chairman,a director, and a $20,000 donation to the Semper Fi Wounded Warrior Fund, an organization for which Mr. Conway’s wife serves as Board Vice President. In addition, the Board considered that, in 2019,2021, the Textron Charitable Trust made a $50,000 donation to The Atlantic Council, an organization for which Ms. James serves as a director. Textron has supported The Atlantic Council since 2002, with the amount of its contribution being $50,000 annually since 2011. The Board determined that these donations have not compromised either director’s independence as a Textron director.

Historically, as reflected in Textron’s Corporate Governance Guidelines and Policies, the Board has determined that the practice of combining the positions of Chairman of the Board and Chief Executive Officer serves the best interests of Textron and its shareholders. This is because the Board believes that the CEO, with his extensive knowledge of the Company’s businesses and full time focus on the business affairs of the Company, makes a more effective Chairman than an independent director, especially given the size and multi-industry nature of the Company’s business. The Board has committed to review, at least once every two years, whether combining these positions serves the best interests of Textron and its shareholders.

Our independent directors elect a Lead Director from among them for what is expected to be a three-year term with the appointment ratified annually. Currently, Mr. GagnéClark serves as Lead Director. The Lead Director is assigned clearly defined and expansive duties under our Corporate Governance Guidelines and Policies, including:

| ● | Presiding at all meetings of the Board at which the Chairman is not present, including all executive sessions of the Board; |

| ● | Serving, when needed, as liaison between the CEO and the independent directors; |

| ● | Identifying, together with the CEO, key strategic direction and operational issues upon which the Board’s annual core agenda is based; |

| ● | Discussing agenda items and time allocated for agenda items with the CEO prior to each Board meeting, including the authority to make changes and approve the agenda for the meeting; |

| ● | Determining the type of information to be provided to the directors for each scheduled Board meeting; |

| ● | Convening additional executive sessions of the Board; |

| ● | Being available for consultation and direct communication with Textron shareholders; and |

| ● | Such other functions as the Board may direct. |

Textron’s Corporate Governance Guidelines and Policies also require that the Board meet in executive session for independent directors without management present at each regularly scheduled Board meeting. Textron’s Lead Director presides at these sessions and at any additional executive sessions convened at the request of a director. During 2019,2021, the independent directors met in executive session without management present during each of the Board’s six regularly scheduled meetings.

TEXTRON 2022 PROXY STATEMENT 11

The functions of the Board are carried out by the full Board, and, when delegated, by the Board committees, with each director being a full and equal participant. The Board is committed to high standards of corporate governance and its Corporate Governance Guidelines and Policies were designed, in part, to ensure the independence of the Board and include a formal process for the evaluation of CEO performance by all non-management Board members. The evaluation

10 TEXTRON 2020 PROXY STATEMENT

is used by the Organization and Compensation Committee as a basis to recommend the compensation of the CEO. In addition, the Audit Committee, the Nominating and Corporate Governance Committee and the Organization and Compensation Committee are composed entirely of independent directors. Each of these committees’ charters provides that the committee may seek the counsel of independent advisors and each routinely meets in executive session without management present.

BOARD AND COMMITTEE EVALUATIONS

The Board and each of its three principal committees perform a comprehensive self-evaluation on an annual self-evaluation.basis with oversight from the Nominating and Corporate Governance Committee. Each director completes a detailed questionnaire soliciting feedback on a number of matters designed to assess Board and committee performance and effectiveness, including oversight, risk management, Board composition, materials and processes, culture, and accountability, among other topics. Beginning in 2022, the questionnaire will include a question designed to elicit feedback from each independent director with respect to any concerns with any other independent director meeting the qualifications and attributes required of Textron Board members as established by the Nominating and Corporate Governance Committee, including the Board Membership Criteria described on page 4. Any such concerns will be discussed with the Chair of the Nominating and Corporate Governance Committee, the Lead Director or the Chairman, as appropriate. The questionnaires also enable directors to provide written comments designed to allow for more detailed feedback, and written feedback is required for any question for which the director provides a rating below the mid-point of the response range. Results of the evaluations are compiled by the Nominating and Corporate Governance Committee and shared with the full Board and each committee. Each committee discusses its respective evaluation results in executive session and determines if any follow-up actions are appropriate. Additionally, a discussion of the evaluations is held in executive session with the full Board to discuss the results and any other perspectives, feedback, or suggestions that the directors may want to raise.

During 2019,2021, the Board of Directors held six regular meetings and one special meeting.meetings. Directors are expected to regularly attend Board meetings and meetings of committees on which they serve, as well as the annual meeting of shareholders. Each director attended at least 75% of the total number of Board and applicable committee meetings. All directors attended the 20192021 annual meeting of shareholders.

Textron’s Corporate Governance Guidelines and Policies provide that non-management directors may serve on four other public company boards, provided that, in the case of a director who is a chief executive officer of a public company, the limit is two other such boards.

12 TEXTRON 2022 PROXY STATEMENT

The Board of Directors has established the following three standing committees to assist in executing its duties: Audit, Nominating and Corporate Governance, and Organization and Compensation. The primaryKey responsibilities of each of the committees are described below, together with the current membership and number of meetings held in 2019.2021. In addition, the Board of Directors and these committees are actively engaged in oversight of our enterprise risk management process and in our environmental, social and governance initiatives, as separately discussed below. Each of these committees is composed entirely of independent, non-management directors. Each of these committees has a written charter. Copies of these charters are posted on Textron’s website,www.textron.com,, under “Investors—Corporate Governance—Committee Charters,” and are also available in print upon request to Textron’s Secretary.

| Member Name | AUDIT COMMITTEE | NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | ORGANIZATION AND COMPENSATION COMMITTEE | |||

| Kathleen M. Bader |  |   | ||||

| R. Kerry |   |  | ||||

| James T. Conway |  | |||||

|  | |||||

| Paul E. Gagné* |  |  | ||||

| Ralph D. Heath |   |  | ||||

| Deborah Lee James |  |  | ||||

| Lionel L. Nowell III |   |  | ||||

|  | |||||

| James L. Ziemer |   | |||||

| Maria T. Zuber |   |   |

| Member |  | Chair |  | Audit Committee Financial Expert |

* Lead Director

TEXTRON 2020 PROXY STATEMENT 11

| AUDIT COMMITTEE | Meetings in |

Kathleen M. Bader Paul E. Gagné Ralph D. Heath

Deborah Lee James

| Primary Responsibilities: • Assists the Board with its oversight of (i) the integrity of Textron’s financial statements, (ii) Textron’s compliance with legal and regulatory requirements, (iii) the independent auditor’s qualifications and independence, (iv) the performance of Textron’s internal audit function and independent auditor, and (v) risk management • Directly responsible for the appointment, compensation, retention and oversight of Textron’s independent auditors |

The Board has determined that each member of the Audit Committee is independent as defined for audit committee members inunder the listing standards of the New York Stock Exchange.Exchange applicable to audit committee members. No member of the committee simultaneously serves on the audit committees of more than three public companies. The Board of Directors has determined that Mr. Clark, Mr. Gagné, Mr. Heath and Mr. Nowell each are “audit committee financial experts” under the criteria adopted by the Securities and Exchange Commission.

TEXTRON 2022 PROXY STATEMENT 13

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | Meetings in | |

James T. Conway (Chair) Kathleen M. Bader

Deborah Lee James

Maria T. Zuber

| Primary Responsibilities: • Identifies individuals to become Board members and recommends that the Board select the director nominees for the next annual meeting of shareholders, considering suggestions regarding possible candidates from a variety of sources, including shareholders • Develops and recommends to the Board a set of corporate governance principles applicable to Textron • Oversees the evaluation of the Board and its committees • Annually reviews the Board’s committee structure, charters and membership • Makes recommendations on compensation of the Board after conducting an annual review of director compensation and benefits program, consulting with independent board compensation advisors, as appropriate • Annually reviews the Board’s composition, appropriate size of the Board, results of the review of the Board’s overall performance and the strategy of the Company to determine future requirements for Board members • Assists the Board of Directors in fulfilling its oversight responsibilities relating to the Company’s policies and practices regarding environmental, social and governance matters that are significant to the Company | |

The Board has determined that each member of the Nominating and Corporate Governance Committee is independent as defined under the New York Stock Exchange listing standards.

12 TEXTRON 2020 PROXY STATEMENT

| ORGANIZATION AND COMPENSATION COMMITTEE | Meetings in | |

James L. Ziemer (Chair)

Paul E. Gagné Ralph D. Heath

Maria T. Zuber

| Primary Responsibilities: • Approves compensation arrangements, including merit salary increases and any annual and long-term incentive compensation, with respect to the Chief Executive Officer and other executive officers of the Company • Oversees and, where appropriate, takes actions with respect to compensation arrangements applicable to other corporate officers • Amends any executive compensation plan or nonqualified deferred compensation plan of the Company and its subsidiaries to the same extent that the plan may be amended by the Board • Administers the executive compensation plans and nonqualified deferred compensation plans of the Company and its subsidiaries • Approves the Chief Executive Officer’s and other executive officers’ responsibilities and performance against pre-established performance goals • Plans for the succession of the Company’s management, including with respect to the development and diversity of Company management | |

14 TEXTRON 2022 PROXY STATEMENT

See the Compensation Discussion and Analysis (CD&A) beginning on page 2124 for more information on the Organization and Compensation Committee’s processes and the role of management and consultants in determining the form and amount of executive compensation. The Board of Directors has determined that each member of the committee is independent as defined under the New York Stock Exchange listing standards applicable to compensation committee members.

Textron’s Board also maintains an Executive Committee which has the power, between meetings of the Board of Directors, to exercise all of the powers of the full Board, except as specifically limited by Textron’s By-Laws and Delaware law. Currently, Mr. Donnelly, Mr. Clark, Mr. Conway, Mr. GagnéNowell and Mr. Ziemer comprise the Executive Committee, which did not meet during 2019.2021.

The Board oversees the Company’s enterprise risk management process.(“ERM”) process which is designed to identify risks throughout the Company. On a quarterly basis, each business unit and functional area throughout the Company conducts assessments of identified significant business risks under their purview in the categories of financial, information technology, operational, strategic and compliance risks. The assessment results are depicted using a heat map to highlight the potential severity of each risk and likelihood of occurrence, along with mitigation actions, and the identified risks are prioritized and, depending on the probability and severity of the risk, escalated to a cross-functional enterprise risk committee, senior management and the Audit Committee, as appropriate. Management reviews the results of the quarterly risk assessment, including any new material risks or significant changes in key risks, with the Audit Committee each quarter. In addition, management reviews the process, including identification of key risks and steps taken to address them, with the full Board on a periodic basis. These reviews occur at an annual dedicated risk management session, and as part ofERM risks also are identified and discussed during the Board’s annual review of the Company’s strategy.

Although the full Board is responsible for this oversight function, the Organization and Compensation Committee, the Nominating and Corporate Governance Committee and the Audit Committee assist the Board in discharging its oversight duties.

The Organization During the past year, each of the committees held a number of meetings to oversee and Compensation Committee reviewsassess risks related to the subject matters enumerated in its charter, including risks associated with the Company’s compensation programs, to provide incentive compensation arrangements for senior executives that do not encourage inappropriate risk taking. The Nominating and Corporate Governance Committee considers risks related to the subject matters for which it is responsible as identified in its charter, includingtheir respective charters. Among other topics, the Organization and Compensation Committee received reports on and discussed risks related to the Company’s compensation programs and organizational development and talent diversity, and assessed whether risks arising from the Company’s compensation policies and practices for senior executives are reasonably likely to have a material adverse effect on the Company. The Nominating and Corporate Governance Committee, among other things, reviewed risks associated with corporate governance.certain environmental, social and governance matters. Similarly, the Audit Committee discussesheld a number of sessions with management and the independent auditor, as appropriate, (i) risks related to its dutiesreview and responsibilities as described in its charter, (ii)provide feedback on management’s policies and processes for risk assessment and risk management, including with respect to cybersecurity risks, and (iii) in the period between the Board’s risk oversight reviews, management’s evaluation of the Company’s major risks and the steps management has taken or proposes to take to monitor and mitigate such risks.

Accordingly, while each of the three committees contributes to the risk management oversight function by assisting the Board in the manner outlined above, the Board itself remains ultimately responsible for the oversight of risk, and receives report outs from each of the committees, as well as periodic reports from management addressing the various risks, including those related to financial and other performance, cybersecurity and human capital matters.

COMMITTEE AND BOARD OVERSIGHT OF ENVIRONMENTAL, SOCIAL AND GOVERNANCE MATTERS

The charter of the Nominating and Corporate Governance Committee specifically includes as one of its responsibilities assisting the Board in fulfilling its oversight responsibilities relating to the Company’s policies and practices regarding environmental, social and governance (“ESG”) matters that are significant to the Company. An ESG update is on the agenda for each Nominating and Corporate Governance Committee meeting, and the Committee addresses specific matters as appropriate. Our other Board Committees also have oversight responsibility for ESG topics under their purview. The Executive Vice President, General Counsel and Chief Compliance Officer of the Company reports to the Audit Committee on both legal, ethics and compliance matters and environmental, health and safety matters at each Audit Committee meeting. The Organization and Compensation Committee has oversight of management succession, talent development and diversity, equity and inclusion efforts. The Audit Committee and the full Board are also directly engaged with ESG risk management program.areas through our ERM program described above. Sustainability risks, including physical risks related to climate change and risks related to transitioning to a lower carbon economy, are assessed through the ERM program and reviewed with the Audit Committee and the Board, in accordance with the ERM process outlined above.

TEXTRON 20202022 PROXY STATEMENT 1315

CORPORATE GOVERNANCE GUIDELINESRESPONSIBILITY AND POLICIESSUSTAINABILITY

Textron’s

Textron is committed to being a responsible corporate citizen. Our corporate responsibility efforts include the following focus areas:

Working to decrease the environmental impact of our business activities throughout our operations through a carefully developed five-year plan: Achieve 2025 |

Under this plan, for the period from 2020-2025, we will focus on achieving the following goals: |

| · | Reduce greenhouse gas emission intensity by 20%; | |

| · | Reduce energy use intensity by 10%; | |

| · | Reduce water use intensity by 10%; and | |

| · | Reduce waste generation intensity by 10%. |

Enhancing workplace safety and the health and well-being of our employees |

| · | Our Global Environmental Health and Safety (EHS) Policies and Standards establish a management system framework, guided by an enterprise-wide EHS council, that includes goal setting, risk reduction, compliance auditing, and performance reporting throughout the enterprise. | |

| · | Our Achieve 2025 plan includes a five year goal to reduce injury rates by 20%. | |

| · | Performance to the injury rate reduction goal is reported to senior leadership and the Audit Committee of the Board. |

Offering our employees opportunities to grow and develop their careers |

| · | Our talent development programs are designed to prepare our employees at all levels to take on new career and growth opportunities at Textron. | |

| · | Leadership, professional and functional training courses are tailored for employees at each stage of their careers and include a mix of enterprise-wide and business unit-specific programs. | |

| · | The current and future talent needs of each of our businesses are assessed annually through a formal talent review process which enables us to develop leadership succession plans and provide our employees with potential new career opportunities. | |

| · | Leaders from functional areas within each business belong to enterprise-wide councils which review talent to enable us to match employees who are ready to assume significant leadership roles with opportunities that best fit their career paths, which may be in other businesses within the enterprise. |

Working to increase the diversity of our workforce and supporting inclusive workplaces |

| · | Textron is committed to having a diverse workforce and inclusive workplaces throughout our global operations. We believe by employing highly talented, diverse employees, who feel valued, respected and are able to contribute fully, we will improve performance, innovation and collaboration and drive talent retention, all of which contribute to stronger business results and reinforce our reputation as leaders in our industries and communities. | |

| · | For over a decade, Textron has allocated five percent of annual incentive compensation for management-level employees toward achievement of diversity goals. Currently, these goals are specifically focused on hiring diversity as described in the CD&A. | |

| · | In order to increase our transparency around the diversity of our workforce and in response to requests by various shareholders, Textron recently posted its latest EEO-1 data on Textron.com and intends to continue to do so on an annual basis. |

Each year we publish a Corporate Governance GuidelinesResponsibility Report which highlights the actions we have taken during the past year in these and Policies, originally adoptedother environmental, social and governance focus areas. Beginning in 1996 and most recently revised in February 2020, meet or exceed the listing standards adopted by the New York Stock Exchange and are posted on Textron’s website,www.textron.com, under “Investors—Corporate Governance/Corporate Governance Guidelines and Policies,” and are also available in print upon request to Textron’s Secretary.

Textron’s Business Conduct Guidelines, originally adopted in 1979 and most recently revised in September 2010, are applicable to all employees of Textron, including the principal executive officer, the principal financial officer and the principal accounting officer. The Business Conduct Guidelines are also applicable to directors2022 with respect to their responsibilities as members of the 2021 fiscal year, the Company plans to provide disclosure in alignment with the Task Force on Climate-Related Financial Disclosures and the Sustainability Accounting Standards Board of Directors. The Business Conduct Guidelines are posted on Textron’s website,www.textron.com, under “About—reporting frameworks.

Our Commitment—Ethics and Compliance/Business Conduct Guidelines,” and are alsoCorporate Responsibility Report is available in print upon request to Textron’s Secretary. We intend to post on our website at Textron.com/CorpResponsibility/corporate-responsibility-report. Information in the address specified above, any amendmentsCorporate Responsibility Report and on our website is not incorporated by reference into this Proxy Statement or considered to be part of this document.

16 TEXTRON 2022 PROXY STATEMENT

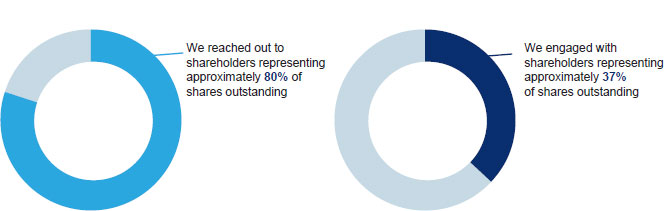

Textron is committed to robust shareholder engagement, and we conduct a regular shareholder outreach program each fall dedicated to corporate governance, executive compensation and corporate responsibility topics. In each of the past several years, we have contacted shareholders representing over 70% of our outstanding shares to hear their views and held an engagement call with each shareholder that accepted our invitation. Our core shareholder engagement team comprises senior members of our investor relations, corporate governance and executive compensation teams, supplemented by our Lead Director or Organization and Compensation Committee chair, as appropriate. These efforts are in addition to normal course outreach conducted by our Investor Relations team and members of senior management with shareholders, portfolio managers and analysts. We also meet with shareholders at investor conferences held throughout the year.

Over the past year, in addition to receiving shareholder feedback related to our executive compensation program, as described on page 35, we had robust discussions with shareholders around various ESG topics, including actions we are taking to reduce our carbon emissions and energy use, our efforts in connection with various human capital issues, such as increasing employee diversity and improving workplace safety, as well as various governance matters. In response to feedback and questions from a number of investors, Textron plans to provide disclosure in alignment with the Task Force on Climate-Related Financial Disclosures and the Sustainability Accounting Standards Board reporting frameworks, beginning in 2022 with respect to the Business Conduct Guidelines or the grant2021 fiscal year. In addition, as requested by a number of a waiver from a provision of the Business Conduct Guidelines requiring disclosure under applicable Securities and Exchange Commission rules within four business days following the date of the amendment or waiver.our shareholders, we have posted Textron’s EEO-1 employee diversity data on Textron.com.

SHAREHOLDER COMMUNICATIONS TO THE BOARD

Shareholders or other interested parties wishing to communicate with the Board of Directors, the Lead Director, the non- managementnon-management directors as a group or with any individual director may do so by calling (866) 698-6655 (toll-free) or (401) 457-2269, writing to Board of Directors at Textron Inc., 40 Westminster Street, Providence, Rhode Island 02903, or by e-mail to textrondirectors@textron.com. The telephone numbers and addresses are also listed on the Textron website. All communications received via the above methods will be sent to the Board of Directors, the Lead Director, the non- management directors or the specified director.

NomineesDirector candidates suggested by shareholders will be communicated to the Nominating and Corporate Governance Committee for consideration in the committee’s selection process. Shareholder-recommended candidates are evaluated using the same criteria used for other candidates. The committee also periodically retains a third-party search firm to assist in the identification and evaluation of candidates.

Textron’s By-Laws contain a provision which imposes certain requirements upon nominations for directors made by shareholders, including proxy access nominees, at the annual meeting of shareholders or a special meeting of shareholders at which directors are to be elected. Shareholders wishing to nominate an individual for director at the annual meeting must submit timely notice of nomination within the time limits described below, under the heading “Shareholder Proposals and Other Matters for 20212023 Annual Meeting” on page 55,58, to the committee, c/o Textron’s Secretary, along with the information described in our By-Laws.

All candidates are evaluated against the Board’s needs and the criteria for membership to the Board set forth above. The committee must also take into account our By-Laws which provide, without provision for exemption, condition or waiver, that no person shall be elected a director who has attained the age of 75. In addition, the Corporate Governance Guidelines and Policies provide that a substantial majority of the Company’s directors must be independent under the standards of the New York Stock Exchange. All recommendations of nominees to the Board by the committee are made solely on the basis of merit.

During 2019,2021, for their service on the Board, non-employee directors were paid an annual cash retainer of $260,000 ($135,000$125,000 and, on the date of which was required to be deferred and paid in the form of2021 Annual Meeting, were issued stock-settled restricted stock units as discussed below).(“RSUs”), valued at $145,000. The RSUs will vest in one year unless the director elects to defer settlement of the RSUs until the director’s separation from service on the Board. The annual cash retainer isand the RSUs are prorated for directors who serve on the Board for a portion of the year.

Each member of the Audit Committee (including the chair) received an additional cash retainer of $15,000, and the chairs of the Audit Committee, the Nominating and Corporate Governance Committee and the Organization and Compensation Committee received, respectively, an additional $15,000, $15,000 and $20,000, and the Lead Director received an additional $30,000.$35,000.

TEXTRON 2022 PROXY STATEMENT 17

For 2022, the additional retainer for the chair of the Nominating and Corporate Governance Committee has been increased to $20,000. In addition, Textron reimburses each director for his or her expenses in attending Board or committee meetings.

14 TEXTRON 2020 PROXY STATEMENT

Textron maintains a Deferred Income Plan for Non-Employee Directors (the “Directors’ Deferred Income Plan”) under which they can defer all or part of their cash compensation until retirement from the Board. Deferrals are made either into an interest-bearinginterest bearing account which bears interest at a monthly rate that is one-twelfth of the greater of 8% and the average for the month of the Moody’s Corporate Bond Yield Index, but in either case, not to exceed a monthly rate equal to 120% of the Applicable Federal Rate as provided under Section 1274(d) of the Internal Revenue Code, or into an account consisting of Textron stock units, which are equivalent in value to Textron common stock. Textron credits dividend equivalents to the stock unit account. Directors were required to defer a minimum of $135,000 of their 2019 annual retainer into the stock unit account.

Textron sponsors a Directors Charitable Award Program that was closed to new participants in 2004. Under the program, Textron contributes up to $1,000,000 to the Textron Charitable Trust on behalf of each participating director upon his or her death, and the Trust donates 50% of that amount in accordance with the director’s recommendation among up to five charitable organizations. Textron currently maintains life insurance policies on the lives of the participating directors, the proceeds of which may be used to fund these contributions. The premiums on the policies insuring our current directors who participate in this program (Ms. Bader and Messrs. Clark Fish and Gagné) have been fully paid so there were no expenditures associated with these policies during 2019.2021. The directors do not receive any direct financial benefit from this program as the insurance proceeds and charitable deductions accrue solely to Textron. Non-employee directors also are eligible to participate in the Textron Matching Gift Program under which Textron will match contributions of directors and full-time employees to eligible charitable organizations at a 1:1 ratio up to a maximum of $7,500 per year.

Non-employee directors are eligible to receive awards granted under the Textron Inc. 2015 Long-Term Incentive Plan. Other thanIn addition to the RSUs described above, our current directors received a one-time grant of 2,000 shares of restricted stock (the “Restricted Shares”) received upon joining the Board, they currently do not receive any such awards.Board. The Restricted Shares do not vest until the director has completed at least five years of Board service and all successive terms of Board service to which he or she is nominated and elected or in the event of death or disability or a change in control of Textron. At its December 2021 meeting, the Board eliminated this one-time stock grant for new directors joining the Board after 2021. This change was recommended by the Nominating and Corporate Governance Committee after its annual review of director compensation, in light of the annual grant of RSUs now made to our independent directors and to better align with current practice at similar companies.

None of our directors receive compensation for serving on the Board from any shareholder or other third party. Employee directors do not receive fees or other compensation for their service on the Board or its committees.

Changes to Director Compensation Program for 2020

In December 2019, the Nominating and Corporate Governance Committee conducted its annual review of the type and amount of compensation paid to our non-employee directors for their service on our Board and its committees. The Committee considered the results of an analysis prepared by its independent compensation consultant, Semler Brossy Consulting Group, which included non-employee director compensation trends and data from Textron’s Talent Peer Group companies as well as companies included in the 2018-2019 NACD Annual Director Compensation Survey. After its review, the Committee recommended, and the Board approved, increasing the annual retainer for our non-employee directors for 2020 from $260,000 to $270,000, of which $145,000 will be in the form of equity, and increasing the Lead Director’s annual retainer from $30,000 to $35,000.

In addition, the Committee recommended, and the Board approved, issuing the equity portion of the annual Board retainer in the form of stock-settled restricted stock units (“RSUs”) rather than as deferred stock units under the Directors’ Deferred Income Plan (as described above). The RSUs will be issued annually on the date of the annual meeting, beginning with the 2020 annual meeting, and will vest in one year unless the director elects to defer settlement of the RSUs until the director’s separation from service on the Board. No changes were made related to the cash portion of the annual Board retainer or to the ability of directors to defer all or part of their cash compensation until retirement from the Board.

These changes are intended to align Textron’s program more closely with peer company practices. With regard to the increase in the annual retainer, the Board believes that modest, biennial increases are preferable to less frequent, larger increases which otherwise would be needed to keep pace with peer company levels.

TEXTRON 2020 PROXY STATEMENT 15

Director Compensation Table

The following table provides 20192021 compensation information for our directors other than Mr. Donnelly, whose compensation is reported in the Summary Compensation Table on page 38.39.

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | All Other Compensation ($)(2) | Total ($) | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | All Other Compensation ($)(2) | Total ($) | ||||||||||||||||

| Kathleen M. Bader | 140,000 | 135,000 | 275,000 | 140,000 | 145,000 | 285,000 | ||||||||||||||||||

| R. Kerry Clark | 155,000 | 135,000 | 7,500 | 297,500 | 168,626 | 145,000 | 5,000 | 318,626 | ||||||||||||||||

| James T. Conway | 140,000 | 135,000 | 275,000 | 140,000 | 145,000 | 8,500 | 290,000 | |||||||||||||||||

| Lawrence K. Fish | 125,000 | 135,000 | 260,000 | |||||||||||||||||||||

| Paul E. Gagné | 170,000 | 135,000 | 305,000 | 151,154 | 145,000 | 296,154 | ||||||||||||||||||

| Ralph D. Heath | 140,000 | 135,000 | 5,000 | 280,000 | 140,000 | 145,000 | 285,000 | |||||||||||||||||

| Deborah Lee James | 140,000 | 135,000 | 275,000 | 140,000 | 145,000 | 7,500 | 292,500 | |||||||||||||||||

| Lloyd G. Trotter | 140,000 | 135,000 | 7,500 | 282,500 | ||||||||||||||||||||

| Lionel L. Nowell III | 150,220 | 145,000 | 3,500 | 298,720 | ||||||||||||||||||||

| James L. Ziemer | 145,000 | 135,000 | 280,000 | 145,000 | 145,000 | 7,500 | 297,500 | |||||||||||||||||

| Maria T. Zuber | 125,000 | 135,000 | 260,000 | 125,000 | 145,000 | 270,000 | ||||||||||||||||||

| (1) | The amounts in this column represent the grant date fair value of the |

| (2) | The amounts in this column represent the amounts of matching contributions made by the Company on behalf of participating directors pursuant to the Textron Matching Gift Program. Amounts over $7,500 for an individual director were paid in 2021 to match gifts made in 2020. |

18 TEXTRON 2022 PROXY STATEMENT

DIRECTOR STOCK OWNERSHIP REQUIREMENTS

In order to align the financial interests of our directors with the interests of our shareholders, we require that our directors maintain a specified level of stock ownership equal to eight times the portion of their annual retainer payable in cash. Toward this end, in 2019prior to 2020 we required all non-employee directors to defer a minimum of $135,000 of their annual retainer into the stock unit account of the DirectorsDirectors’ Deferred Income Plan.Plan and, beginning in 2020, each year on the date of our Annual Meeting, we issued RSUs to directors valued at $145,000. All directors currently meet the stock ownership requirement, which allows them to achieve the required level of ownership over time in the case of directors who have more recently joined the Board. We also have a stock retention policy restricting non-employee directors from transferring the Restricted Shares or the stock units credited under the Directors’ Deferred Income Plan while they serve on the Board. As described above, RSUs will be issued to directors beginning in 2020 for the equity portion of their annual retainer. To the extent that directors do not defer settlement of their RSUs, they may not sell shares of common stock received upon vesting of RSUs unless the stock ownership requirement has been met.

ANTI-HEDGING AND PLEDGING POLICY

Our directors are prohibited from (i) pledging Textron securities as collateral for any loan or holding Textron securities in a margin account or (ii) engaging in short sales of Textron securities or transactions in publicly-traded options or derivative securities based on Textron’s securities.

CORPORATE GOVERNANCE GUIDELINES AND POLICIES

16Textron’s Corporate Governance Guidelines and Policies, originally adopted in 1996 and most recently revised in February 2022, meet or exceed the listing standards adopted by the New York Stock Exchange and are posted on Textron’s website, www.textron.com, under “Investors—Corporate Governance—Corporate Governance Guidelines and Policies,” and are also available in print upon request to Textron’s Secretary.

Textron’s Business Conduct Guidelines, originally adopted in 1979 and most recently revised in September 2010, are applicable to all employees of Textron, including the principal executive officer, the principal financial officer and the principal accounting officer. The Business Conduct Guidelines are also applicable to directors with respect to their responsibilities as members of the Board of Directors. The Business Conduct Guidelines are posted on Textron’s website, www.textron.com, under “Corporate Responsibility—Ethics and Compliance--Textron’s Business Conduct Guidelines,” and are also available in print upon request to Textron’s Secretary. We intend to post on our website, at the address specified above, any amendments to the Business Conduct Guidelines or the grant of a waiver from a provision of the Business Conduct Guidelines requiring disclosure under applicable Securities and Exchange Commission rules within four business days following the date of the amendment or waiver.

TEXTRON 20202022 PROXY STATEMENT19

| SECURITY OWNERSHIP |

The following table sets forth information regarding the beneficial ownership of our common stock as of January 1, 2020,2022, unless otherwise noted, by:

| ● | Each person or group known by us to own beneficially more than 5% of our common stock; |

| ● | Each of our directors; |

| ● | Each of our named executive officers, as defined under Securities and Exchange Commission rules (“NEOs”); and |

| ● | All of our current directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes any shares over which a person exercises sole or shared voting or investment power. Shares of common stock subject to options that are exercisable, or restricted stock units that will vest, within 60 days of January 1, 2020,2022, and shares held for the executive officers by the trustee under the Textron Savings Plan, are considered outstanding and beneficially owned by the person holding the option or unit or participating in the Plan but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Each shareholder listed below has sole voting and investment power with respect to the shares beneficially owned, except in those cases in which the voting or investment power is shared with the trustee or as otherwise noted.

| Directors and Executive Officers | Number of Shares of Common Stock | Percent of Class | Number of Shares of Common Stock | Percent of Class | ||||||||||

| Kathleen M. Bader | 12,775 | (1) | * | 6,830 | (1) | * | ||||||||

| R. Kerry Clark | 7,000 | (1) | * | 11,830 | (1) | * | ||||||||

| Frank T. Connor | 647,751 | (2)(3) | * | 641,995 | (2)(3) | * | ||||||||

| James T. Conway | 2,034 | (1) | * | 6,872 | (1) | * | ||||||||

| Scott C. Donnelly | 2,277,378 | (2)(3) | * | 2,271,467 | (2)(3) | 1.0 | % | |||||||

| Julie G. Duffy | 56,475 | (2)(3) | * | 102,672 | (2)(3) | * | ||||||||

| Lawrence K. Fish | 2,000 | (1) | * | |||||||||||

| Paul E. Gagné | 5,257 | (1) | * | 10,104 | (1) | * | ||||||||

| Ralph D. Heath | 2,000 | (1) | * | 6,830 | (1) | * | ||||||||

| Deborah Lee James | 2,007 | (1) | * | 6,845 | (1) | * | ||||||||

| E. Robert Lupone | 239,598 | (2)(3) | * | 274,077 | (2)(3) | * | ||||||||

| Lloyd G. Trotter | 2,111 | (1) | * | |||||||||||

| Lionel L. Nowell III | 2,000 | * | 6,833 | (1) | * | |||||||||

| James L. Ziemer | 2,152 | (1) | * | 6,990 | (1) | * | ||||||||

| Maria T. Zuber | 2,009 | (1) | * | 6,850 | (1) | * | ||||||||

| All current directors and executive officers as a group (15 persons) | 3,262,547 | 1.4 | % | |||||||||||

| All current directors and executive officers as a group (13 persons) | 3,360,195 | 1.5 | % | |||||||||||

| Beneficial Holders of More than 5% | ||||||||||||||

| BlackRock, Inc.(4) | 18,311,457 | 8.0 | % | 15,719,446 | 7.2 | % | ||||||||

| T. Rowe Price Associates, Inc.(5) | 31,834,742 | 14.0 | % | 34,357,036 | 15.8 | % | ||||||||

| The Vanguard Group, Inc.(6) | 25,120,943 | 11.0 | % | 23,325,594 | 10.8 | % | ||||||||

| * | Less than 1% of the outstanding shares of common stock. |

| (1) | Excludes (i) stock units held by our non-employee directors under the Directors Deferred Income Plan that are paid in cash following termination of service as a director, based upon the value of Textron common stock, as follows: Ms. Bader, |

TEXTRON 2020 PROXY STATEMENT 17

| (2) | Includes the following shares obtainable within 60 days of January 1, |

20 TEXTRON 2022 PROXY STATEMENT

(3) | Excludes (i) stock units held under non-qualified deferred compensation plans that are paid in cash, based upon the value of Textron common stock, as follows: Mr. Connor, |

(4) | Based on information disclosed in Amendment No. |

(5) | Based on information disclosed in Amendment No. |

(6) | Based on information disclosed in Amendment No. |

18TEXTRON 20202022 PROXY STATEMENT21

| AUDIT COMMITTEE REPORT |

The Audit Committee of the Board of Directors has furnished the following report on its activities:

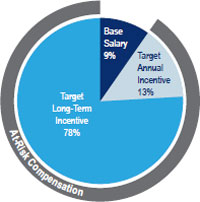

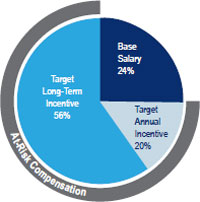

The committee reviewed and discussed the audited consolidated financial statements and the related schedule in the Annual Report referred to below with management. The committee also reviewed with management and the independent registered public accounting firm (the “independent auditors”) the reasonableness of significant judgments, including critical audit matters, and the clarity of disclosures in the financial statements, the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the committee by applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission. In addition, the committee discussed with the independent auditors the auditors’ independence from management and the Company. This discussion included the matters in the written disclosures and the letter from the independent auditors required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communication with the audit committee concerning independence and considered the possible effect of non- audit services on the auditors’ independence.